Reporting Your Car’s Damage Using the Lemonade App

If you ever need to file a car insurance claim, you’ll want to do it like this.

Ever had to file a car insurance claim for damages after a crash? Getting in an accident is a bummer to begin with. But when the reimbursement from your insurance carrier is delayed because you’re going back and forth confirming your car’s appraisal details, you wind up pulling your hair out.

At Lemonade Car, we do everything we can to get drivers a payout for their claim for a covered accident as fast as possible. We built a way to help streamline an important part of the process, making it easier for you to report any damage to your car using the Lemonade app. (We’ll layout some snapshots of this helpful process later.)

Crashes can be chaotic. After a car accident, the most important thing to do is make sure everyone in your car, and at the entire accident scene, is safe. After that, follow a post-accident checklist to collect all the important details necessary to file a claim.

That list includes things like:

Including the right photos and details in your car insurance claim is the best way to accelerate your claims process and get reimbursed faster.

What your insurance company really needs is a clear, 360-degree view of your car—as well as some extras, like a shot of your odometer, and images of the surrounding car accident scene itself, when possible.

But in the aftermath of a car crash, it can be tough to remember best practices for reporting your car’s damage to your insurer. What are you supposed to take pictures of, exactly? What if you forget something really important?

Not sending enough photos—or sending photos taken too close to the vehicle damage, in the dark, or with wonky reflections from your camera flash—simply slows down your claim.

With that in mind, our team built an easy and intuitive process that helps drivers capture the details and images that their claim will actually need. That means less back-and-forth with our team, and less of a headache overall.

The secret sauce of Lemonade’s in-app claims experience is that we harness the power of technology to handle claims more quickly, and without hassle. It’s one of the ways we support our drivers during a stressful moment.

You don’t need special photography skills, or a professional grade camera, to get the right photos for your car insurance claim. Just have your phone handy, and your damaged car nearby.

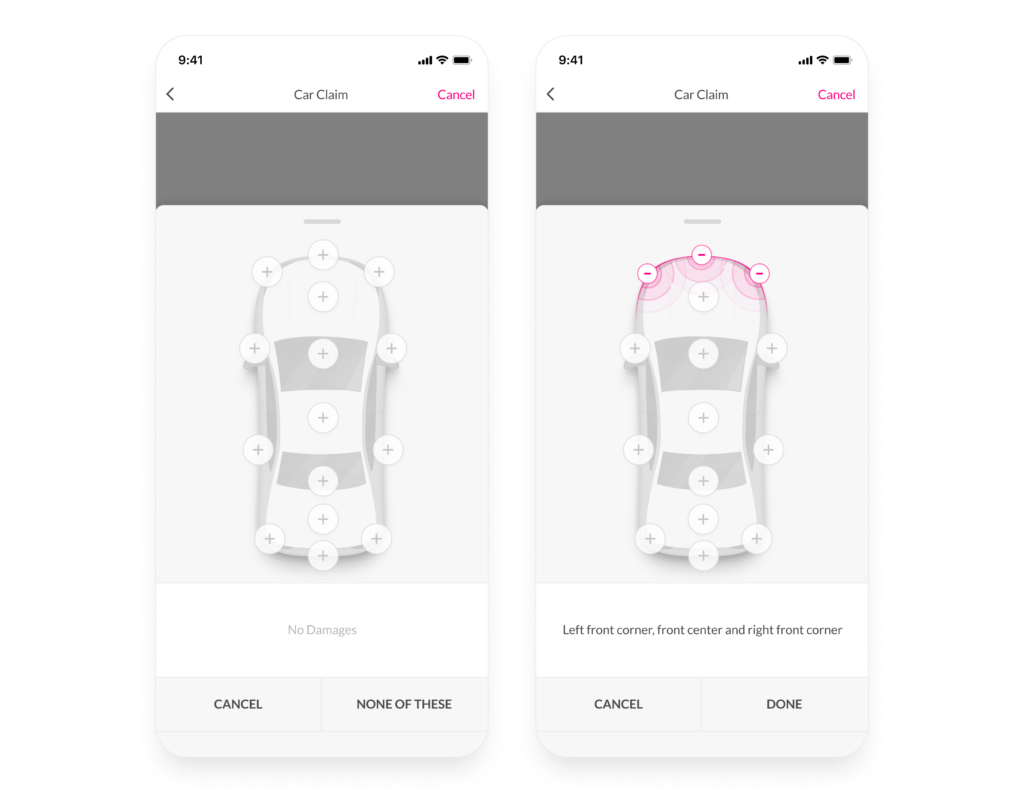

When you drive with the Lemonade app and need to file a claim, we make it simple. Our friendly chatbot AI Jim will guide you through each step of reporting your car’s damage. It’s an exceedingly easy and intuitive process—but we’ll break down how it works below, if you’re curious.

You’ll be able to tap and identify which parts of your car were damaged using an interactive graphic. Just click on all of the relevant ‘+’ icons to specify any damage to your windshield, rear bumper, and so on.

Next, you’ll need to include some photos of your car’s damage. Make sure to snap photos of all the areas of your car you marked as damaged in the previous step. We recommend that you include both close-ups and shots taken from a few feet away.

AI Jim will give you two photo collection options to choose from in this step:

After snapping some close-ups of the damage, you’ll need to literally take a step back so we can see the bigger picture of the situation. The app will guide you as you take a few more photos—five, to be exact—that capture all the different angles of your car, and one of the odometer while the engine is turned on.

Don’t sweat the details, we’ll guide you through snapping and saving each photo individually, and you can retake each photo as many times as you need before saving it.

We built this process to make sure that we get super clear, accurate images of damage after an accident. That said, if we still don’t get all the photos we need, a (human) claims pro will follow up directly to sort things out.

Lemonade Car is a new kind of car insurance. We offer awesome coverage, we price policies fairly based on how much and how well you actually drive, and we use an empathetic approach to build an easy, hassle-free experience.

Our great coverage and super fast claims resolution don’t stop at Lemonade Car though. Did you know we also offer renters, homeowners, and pet health insurance? Not only will you become eligible for our bundling discounts, but you can also manage each of your Lemonade policies—and file claims—through the same app you use for Lemonade Car.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage may not be available in all states.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.