Driving fewer miles than the average American can often help lower your car insurance costs—not to mention all the money you’ll save on gas.

Most car insurers customarily offer low-mileage discounts. But more recently, a new kind of car insurance program has emerged that benefits drivers who don’t go the extra mile (according to their odometers).

This type of program has many names—usage-based, pay as you go, and pay per mile car insurance—but they are all based on the same basic idea. For the sake of this article we’ll refer to it just as pay per mile.

Let’s take a look at what benefits a pay per mile policy offers, how it differs from a traditional car insurance policy, and whether it might be a good fit for your lifestyle.

- With a pay per mile car insurance program you determine how much you save based on how much you drive.

- Each month you pay a different price; it’s a calculation of the number of miles you drive multiplied by your per-mile price, plus your base price.

- Like traditional car insurance programs, pay per mile policies offer the same standard insurance coverage options and add-ons.

- Your base price will depend on a lot of factors—like the state you live in, your car’s make and model year, your driving history, driving habits, and the specific coverages you include on your policy.

- With a pay per mile program, your mileage is usually determined using a simple mobile app or a plug-in telematics device in the car.

What is pay per mile insurance?

Pay per mile is a type of car insurance that largely prices your policy based on the number of miles you drive. Each month you pay a different price—based on the number of miles you drive multiplied by your per-mile price, plus your base price.

This usually means that low-mileage drivers end up with lower auto insurance rates, saving as much as 40% a year.

How does pay per mile insurance compare to a traditional car insurance policy?

The coverage offered on a pay per mile policy is largely the same as a traditional car insurance policy. But you’ll see big differences in the way your monthly premium is calculated, and your price will change each month depending on how many miles you drive.

That said, don’t underestimate how important mileage is as a factor in a traditional car insurance premium. Drivers may be rewarded with low-mileage discounts on traditional policies if they are behind the wheel less than the average American, who typically drives around 14,263 miles annually (or about 1,200 miles per month).

So, how does pay per mile insurance work?

With a pay per mile plan you pay a monthly base price that doesn’t change, in addition to a per-mile price that’s based on how much you drove that month. While the per-mile price may look like a really small number—mere cents—it can quickly add up.

Let’s say you have a pay per mile policy with a base rate of $29 per month, plus a 6¢ per-mile price. If you’re behind the wheel as much as the average American driver, you would pay about $72 for your mileage each month, in addition to that $29 base rate, which comes out to $101 for a month of car insurance.

If you drive half as much as the average American driver, your monthly premium could come out to about $65. This is one of the things that makes a pay per mile program so appealing to low-mileage drivers.

Of course, these numbers are hypotheticals. Your own price will vary depending on the state you live in, your insurer, your driving history and driving habits, and your car’s make and model year—along with other factors, like the specific coverages you include on your policy.

How does my car insurer know how many miles I drive?

When you’re shopping around for car insurance quotes, car insurance providers will generally request an estimate of your total mileage. They may later ask you to verify it with a regular odometer reading.

If you’d like to figure out your car’s annual mileage, start by taking a look at the mileage currently on your car’s odometer. If you know how old your car is, divide that mileage by the age of the car. If you don’t know what year your car was manufactured, you can find this information on the driver’s door jamb of your car.

With a pay per mile program, your insurer will need an accurate reading of how much you’re driving each month. As a result, mileage is usually determined using a simple mobile app or a plug-in telematics device in the car.

Can I customize a pay per mile insurance policy?

Yes, you can customize your policy! Like traditional car insurance programs, pay per mile policies include the same standard insurance coverage options and add-ons—like liability coverage, and comprehensive and collision coverages (if you’re confused about the differences, we clear it up here).

You can customize the coverages on your policy to best fit your needs, just keep in mind that this will affect the monthly base rate that you pay as part of your premium.

What other factors determine my pay per mile insurance premium, besides the number of miles I drive?

Beyond mileage, car insurance companies calculate a lot of different factors to determine your premium—like your driving behavior and driving record.

Since pay per mile insurance prices your policy based on your mileage, you’ll usually need to drive with some kind of device or app that helps your insurance company determine how many miles you’ve driven. It’s also worth keeping in mind that these devices can usually sense more than just the miles driven. For example, these types of devices or apps can generally tell if you have a habit of speeding or braking harshly.

On the flipside, the same devices will be able to register all the good driving habits you doubtlessly engage in, like daytime driving (when there isn’t traffic) and sticking to well-maintained roads. Building a real-time record of safe driving can help lower your price.

How will my pay per mile premium be affected if I take a long trip?

The point of a pay per mile program is to help drivers with a low-mileage lifestyle save money. But don’t worry, these programs generally have buffers to protect you from ruining your low-mileage track record when you decide to hit the road for the occasional longer drive or road trip.

Some pay per mile programs have a daily limit, where you won’t be charged after a certain number of miles on a single trip or day. This limit varies depending on the insurer and state—like Metromile, who in some cases won’t charge for more than 150 miles driven in a day—so it’s worth checking with your insurer before you hit the open road.

Is a pay per mile insurance program right for me?

Depending on how often and how far you regularly drive, a pay per mile insurance program could be a cheaper option than a traditional policy.

You determine how much you save based on how much you drive. So if you find yourself driving a lot every month, pay per mile might not be for you. These types of car insurance programs are geared towards drivers with a low-mileage lifestyle.

If you recognize yourself in any of the following low-mileage driver profiles, it may be worth considering a pay per mile insurance program.

You work from home or don’t commute regularly

If you spend most of your time working from your home office or your favorite walking-distance coffee shop, you likely rack up fewer miles than a driver who commutes daily. You could save on your car insurance premium with a pay per mile program if you’re one of these WFH diehards.

You take advantage of the awesome public transit system and ride share options in your area

Prefer the commuter train or a Lyft to endless gridlock traffic and parking headaches?

The more time you spend taking public transit and ride sharing is less time you spend behind the wheel—and that could mean more savings on car insurance with a pay per mile program.

You’re a college student who lives on or near your campus

If you spend more time in the chemistry lab, library, and your dorm room than on the road, you might be spending too much on a traditional car insurance policy that isn’t right for your low-mileage lifestyle.

A pay per mile program may offer lower rates when you have a car that stays parked most of the time because you’re buried in lectures and cramming for exams.

You’re a golden-aged driver

When you’re a retiree, you have so much to look forward to now that long commutes to the office are in the rearview mirror. (And you probably don’t miss them.)

If your day-to-day activities are closer to home now and don’t always require a car to get there, a pay per mile program may work better for your new routine.

Don’t pay for the miles you don’t drive…

With a pay per mile program, you can take savings into your own hands based on how many miles you spend behind the wheel (and how safely you drive when you are). So if you drive less than the average American—which is around 14,263 miles per year—it’s worth looking into whether a pay per mile program is a good fit for you.

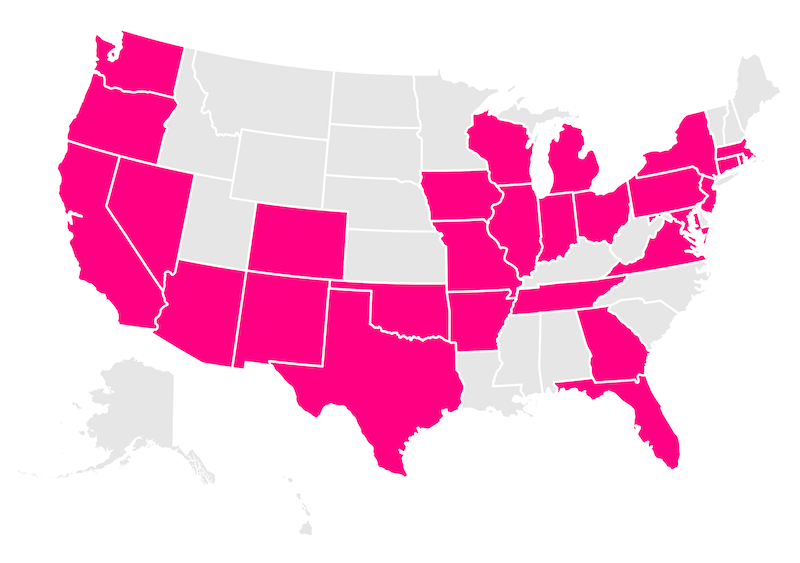

Which states currently offer Lemonade Car insurance?

Arizona, Illinois, Ohio, Oregon, Tennessee, Texas, and Washington.