The national average cost of car insurance in 2024 is roughly $767 per year (or $64 per month).* This average rate is for a minimum coverage policy—meaning it only meets the minimum requirements for an auto insurance policy in that state.

On the other hand, full coverage car insurance—a combination of insurance coverages designed to ‘fully’ cover you in the event of an accident—costs about 156% more than minimum insurance coverage. A full coverage policy would include protections that go beyond your state’s minimum legally mandated coverage, but that would give you extra peace of mind in many different scenarios.

Let’s take a look at all the different coverage options you can choose from, plus consider the factors that impact car insurance prices.

What are some of the main factors that impact car insurance rates?

There are several factors that impact rates for car insurance with Lemonade Car, including:

Your driving record

If you’ve gotten speeding tickets or a DUI recently—or have been involved in many accidents—it’s likely you’ll be considered high-risk by car insurance companies and will pay higher rates for car insurance than someone with a clean driving record.

On the flipside, if you’re an excellent driver with super safe driving habits—like easing around turns, and being gentle on the brakes at stop lights—it could help lower how much you pay for car insurance during renewals at Lemonade Car (granted no new driving violations or claims come up between renewals). Because at Lemonade Car, the way you drive matters.

Your car

The age, make, model and mileage of your car also influence your insurance costs. A car that’s newer is worth more, so the insurer’s potential liability could be higher. Any time an insurer thinks they might have to pay out more on an insurance claim, they’ll price the new policy higher.

But sometimes there are ways to reduce the burden of driving a car that’s statistically more expensive to insure. If you drive a hybrid or electric car, for example, you could be eligible for a car insurance discount on your Lemonade Car policy.

The drivers you include

Adding additional drivers to your policy may affect your premium, depending on their driving history and other factors. For instance, adding a teen driver to your policy (who hasn’t yet built a driving history) could lead to higher auto insurance rates.

Check out who you should cover on your policy here.

Your driving habits

We use location-based technology to tailor car insurance rates based on how you drive. The better you drive over time, the less you’ll pay. Learn more about how Lemonade Car is utilizing location-based services.

How much you drive

Our location-based technology helps us understand how much you drive, on average. If you don’t spend much time behind the wheel, you might end up paying less on coverage than someone with a long daily commute.

Your coverages

Nearly all states require that drivers have at least some form of car insurance. Many drivers choose to add additional coverage types to their policy to keep them more protected on the road. The more car insurance coverage types you add to your policy, the higher your monthly premiums—but keep in mind, if one of these coverages comes in handy, you’ll probably end up paying way less out of pocket if you end up filing a claim.

Your coverage limits

A limit is the maximum amount an insurer would pay out in a covered claim; you can set different limits for your different coverages. If you pick higher limits, the insurer takes on a greater risk—they might end up paying out a lot more in the event of an accident and subsequent claim. Therefore, your monthly premium will be higher if you have a high limit on your policy.

Your deductible

A car insurance deductible is the amount you pay out-of-pocket before insurance coverage kicks in. With a Lemonade policy, it could be anything between $250 and $2,000. Choosing a higher deductible will generally result in lower premiums, since it means you’d be responsible for more of the initial costs in the event of an accident.

What does the cost of Lemonade Car cover?

If you want to take a deep dive into all of the coverage types offered by Lemonade Car, we’ve got you covered here.

If you’re short on time, we’ll give you the TL;DR version of the core Lemonade Car coverage types below:

Liability coverage

If you have renters or homeowners insurance, you might already be familiar with this type of coverage. In car insurance, liability insurance coverage is broken down into two parts: bodily injury liability and property damage liability.

Bodily injury liability coverage. If you accidentally injure someone else who is not a passenger in your car, this will cover their medical bills

Property damage liability coverage. If you damage someone’s car or personal property, this will cover the cost to repair or replace what was damaged

Comprehensive coverage

Also known as “act of god” coverage, comprehensive insurance coverage helps pay to fix damage to your car, or possibly replace it, following an incident that wasn’t a car accident.

What does that mean? Well, if your car is stolen, vandalized, or has an unexpected run-in with an animal, for example, comprehensive coverage kicks in.

Collision coverage

Collision coverage helps pay to repair or replace your own car if it’s damaged in an accident with another vehicle or object, especially if you’re the one who’s responsible. If you’re technically at fault for the damages to your car, your collision coverage will kick-in to cover repairs, and get you back on the road.

Medical Injury Protection (MedPay)/Personal Injury Protection (PIP)

Both medical payments coverage (MedPay) and personal injury protection (PIP) can help cover the costs of medical expenses—like ambulance fees, doctor and hospital visits, and health insurance co-pays—from a covered car accident, but there are some key distinctions.

The main difference is that PIP can additionally cover a percentage of lost wages, public transportation to and from doctor’s appointments, or the costs of essential services you can’t perform while recovering from your injuries.

Also, PIP is sometimes referred to as no-fault insurance because it covers medical expenses from an at-fault accident, no matter who is at fault.

Keep in mind: Even if you have full coverage, which usually combines multiple endorsements such as comprehensive and collision coverage, that doesn’t mean you’re covered for everything, nor does it guarantee your claim will be approved.

How can I lower my car insurance rates?

Every day you drive with Lemonade is quite literally an opportunity to save on your car insurance rates, and lower your car insurance premiums. Seriously.

Lemonade Car is designed with drivers like you in mind. We offer a plethora of ways to put you on the road to lower rates, including:

- Discounts: Lemonade will automatically apply a bundle discount on any combination of our insurance products, including renters, homeowners, and pet insurance.

- Low-mileage lifestyle: We reward low-mileage drivers with lower premiums.

- Driving behavior: Safe driving habits can positively impact your premiums at renewals.

- Coverage and limits: You can easily customize your coverage level and deductible when you sign up for a Lemonade policy, and at any time during your six month policy term, all on the Lemonade app. Keep in mind that lowering your limits or raising your deductible might save you some money on your premiums, but it could also mean paying more if you’re in an accident and need to file a claim.

Get the best coverage without breaking the bank…

The story of Goldilocks and the Three Bears taught us that we shouldn’t settle for anything that doesn’t feel “just right.” None of those bears drove cars, but we still feel like they’d agree with us here: The right car insurance policy is about finding the perfect balance of affordable and excellent coverage.

If you’re interested in learning more about a policy with Lemonade Car, the easiest way to explore your coverage options—and what you’d pay—is by applying for a quote. It’s fast, easy, and even a little fun.

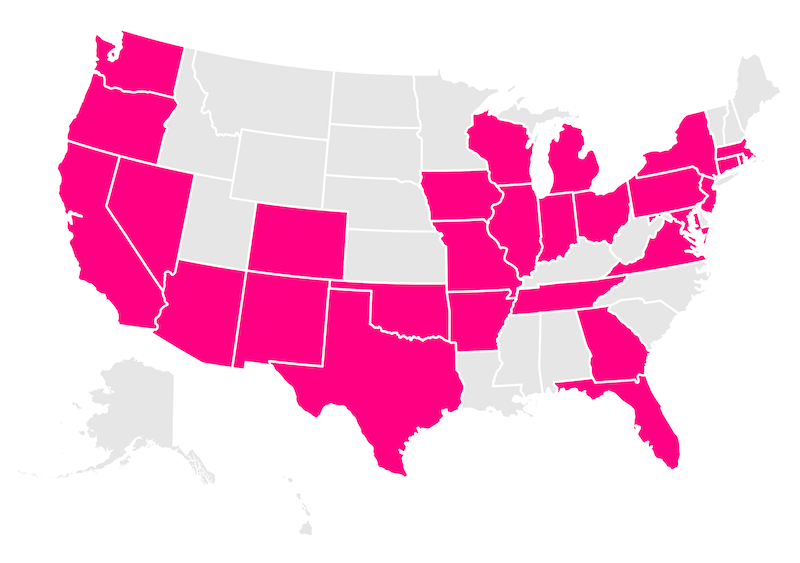

Which states currently offer Lemonade Car insurance?

Arizona, Illinois, Ohio, Oregon, Tennessee, Texas, and Washington.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage may not be available in all states.

*https://www.valuepenguin.com/average-cost-of-insurance, Accessed March 2024.