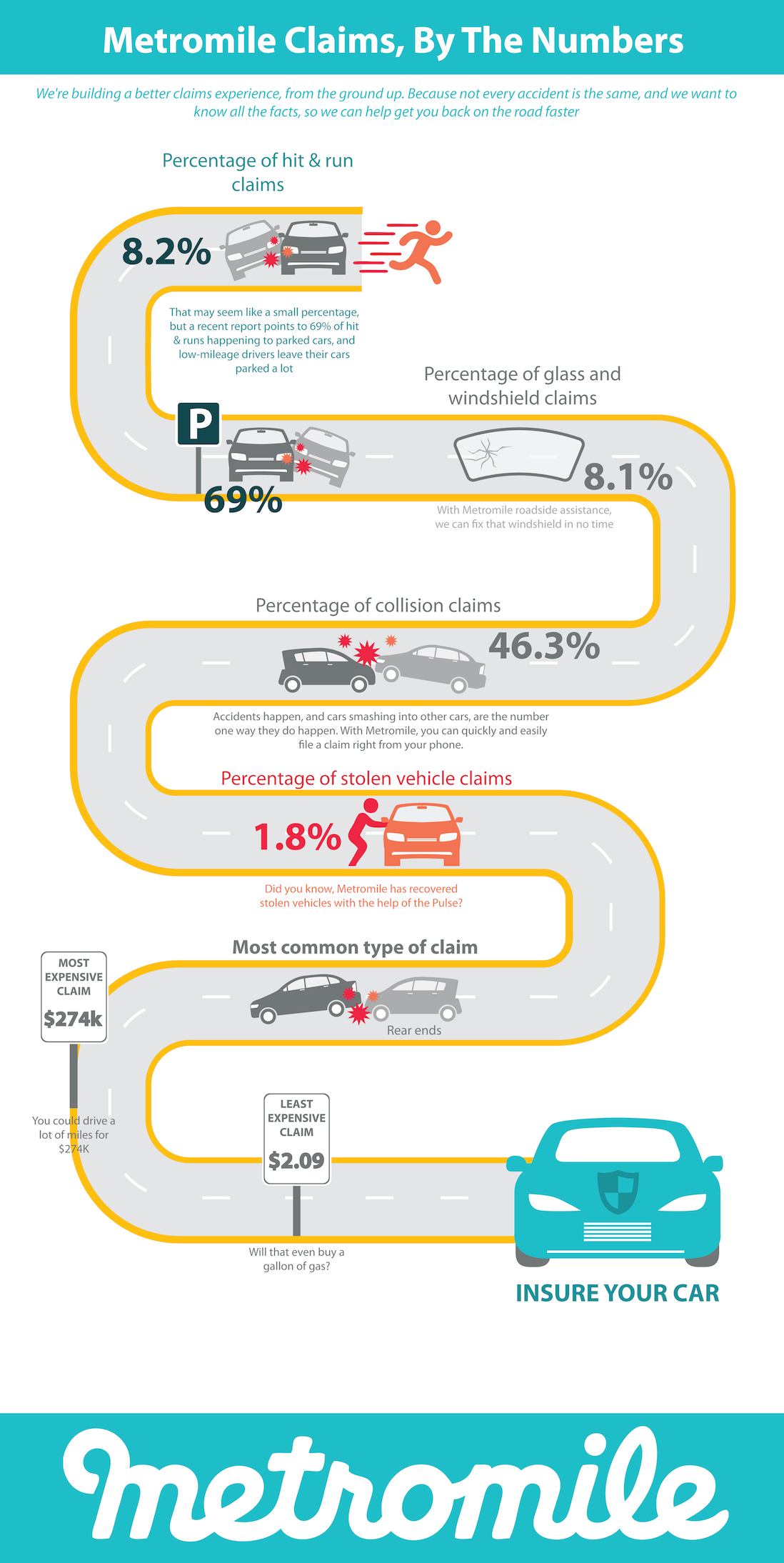

Filing a car insurance claim doesn’t have to be intimidating. In fact, with Metromile’s step-by-step process, we will walk you through the steps to filing a claim and offer a simple solution to an often overly-complicated procedure. Whether you’ve experienced a hit-and-run, a minor fender bender sitch, or are in need of a quick glass repair, knowing what you should have prepared to file a claim can make for a seamless experience and get you back on the road faster.

First, we need to know what type of claim you will be filing – roadside assistance, a glass and windshield claim, a hit-and-run claim, or a general claim. Knowing which type of claim will help us direct your claim to the right department.

So, which types of claims fall into which categories? Pull up a chair and let’s chat.

As we all know, cars can be somewhat unpredictable. If your car decides to break down at the worst possible time, Metromile has got your back! If your car breaks down on the road and you have elected Metromile Roadside Assistance coverage, you can submit an Online Roadside Assistance Request, file through the Metromile app, or call Metromile Roadside Assistance at 800-983-3400 to request service. Our Metromile Roadside Assistance team will make arrangements to assist you and also can provide an estimated time of arrival.

Glass and Windshield Claims

Has an errant, high-velocity pebble taken a hit to your windshield? File a claim through Metromile’s Glass and Windshield claims center. If you need to file a claim for a broken window or windshield, and you have purchased comprehensive coverage, you can file a glass only claim online, file through the Metromile app, or call Metromile Glass Assistance at 888-256-8375 to report a claim.

Hit-and-run Claims

As a vehicle owner, one of the most frustrating situations you might be involved in is a hit-and-run. If you are the victim of a hit-and-run, you should definitely file an accident report with the police. The more information you can provide in the instance of a hit-and-run, the better. Information to provide (if it’s available):

- Information about the car that hit you:

- Any possible witness information

- Time and location of the accident

- Pictures of the accident scene

- Pictures of your car

We understand that in certain situations, it may not be possible to provide all of the above information. At the bare minimum, be sure to have the following information handy when filing your claim:

- Time of incident

- Location of hit-and-run

- The damage

- The Accident Report Number (obtained from the police)

Metromile policyholders can always file a hit-and-run claim online or through the Metromile app 24/7 – or you can report a claim by calling (888) 595-5485.

General Claims

For everything else: file a general claim. Metromile policyholders can file a claim online or through the Metromile app 24/7, or you can report a claim with a claims representative by calling (888) 595-5485 M-F 6am-6pm. You will need the following information readily available when filing your claim:

- Your Metromile insurance policy number

- Date of the accident

- Location of the accident

- Description of the accident

- Party names

- Vehicles involved

We also recommend that you:

- Take pictures of (or write down) driver and occupant names, contact numbers and driver’s license information

- Obtain insurance carrier information (including policy number) from the other person(s) involved

- Write down vehicle information for any vehicles involved in the accident including: make, model, license plate number and damages

- Write down any witness information

- Take pictures of the accident scene, skid marks, and debris (if it is safe to do so)

So, what now? After you’ve filed your claim through Metromile, here are some next action steps to take.

Repairing Your Vehicle

The first thing you’ll need to get is a damage estimate. Your Metromile Claims Representative will be able to guide you through the repair process. In most situations, we’re able to complete an estimate from photos of the damage to your vehicle.

HOWEVER. If you are not ready to repair your car, that’s okay too. Metromile does not require you to repair your car in order to submit a claim. When filing, just let your claims representative know that you aren’t ready to repair your car.

In the case of a total loss, Metromile defers to the state rules regarding how to determine the value of your vehicle. If your vehicle is deemed a total loss (as outlined by your state rules), your policy remains in effect. You will need insurance for your rental car or temporary transportation while you shop for a replacement – however, we won’t charge you mileage while you’re shopping for a replacement vehicle. Once obtained, contact Metromile to add your replacement vehicle to your policy.

With Metromile, you never have to wonder if your insurance company has your back, because we always will! Get a free quote today and join the Metromile fam – we’re always one call, tap, or click away. Be safe out there and see you on the roads!

Julianne Cronin is a Bay Area freelance writer, content creator, and founder/editor of the women’s lifestyle site, The Wink.