Metromile is committed to making car insurance more accessible and easier than ever before. We know insurance can be confusing, but our goal is to simplify the whole process. We want to save our customers the time and hassle of having to manage their insurance policy, and instead give them the peace of mind of knowing Metromile has your back, no matter what. But we also understand that your insurance needs may change over time; you may get a new car, move in with a boyfriend, or even sell an older car. Did you know that with Metromile you can make changes to your policy online or right from your mobile app? Save your precious time and add your vehicle or change your address with a few clicks of your fingers.

Trying to get the hang of how to navigate your Metromile online dashboard? Maybe you would place yourself in the not so tech-savvy category? Don’t worry we put together steps on how to complete several different changes (what we call “endorsements”) to your Metromile policy.

How to Make Changes to Your Metromile Policy: Self-Service Endorsements

The first step is to be logged into your account. All changes can be made by clicking the “Policy” tab at the top of the page.

Adding/removing a vehicle:

-

1. Click the ADD OR EDIT VEHICLES button.

- click ADD NEW VEHICLE, enter your new vehicle information in.

- Select NEXT.

- The following screen will be the VEHICLE COVERAGE screen. Your rates will update on the right hand side.

- Select SAVE VEHICLE at the bottom.

- Click Remove.

- A pop-up asking you to confirm changes will appear. Click ‘confirm.’

2. A screen will pop up to type your password in.

3. You will be taken to the Edit Policy page.

4. If you want to ADD a New Vehicle:

5. If you want to REMOVE a vehicle:

Adding/removing a driver:

-

1. Click the ADD OR EDIT DRIVERS button.

- Enter in the driver information.

- Click ADD DRIVER.

- Rates will update on the right hand side.

- Click REMOVE DRIVER.

- A screen will pop up with a disclaimer to read.

- Once reading it through to proceed push YES, REMOVE.

2. A screen will pop up to type your password in.

3. You will be taken to the Edit Policy page.

4. Click ADD A NEW DRIVER, REMOVE A DRIVER, or EDIT an existing driver.

5. If you’re adding a new driver:

6. If you’re removing a driver:

Changing Policy Coverages:

-

1. Click the “Add or Edit Drivers” button.

2. A screen will pop up to type your password in.

3. You will be taken to the Edit Policy page.

4. Under Vehicles in the Edit Policy page, you will a Policy Coverage section, push EDIT option.

5. Choose your new limits.

6. Click SAVE.

Changing Vehicle Coverages:

-

1. Click the “Add or Edit Vehicles” button.

2. A screen will pop up to type your password in.

3. Click EDIT COVERAGE on the specific vehicle you wish to edit.

4. Choose your new coverage options.

5. Click SAVE.

Changing Vehicle Lienholder:

-

1. Click the “Add Lienholder” button.

2. A screen will pop up to type your password in.

3. Under the specific vehicle, click Add Lienholder.

4. Enter in your lienholder information.

5. Click SAVE.

Updating/Changing Your Address:

-

1. Depending on whether you are updating your garaging address or mailing address click “EDIT” next to the one you would like to update.

2. A screen will pop up to type your password in.

3. You will be taken to the Edit Policy page.

4. Click EDIT next to the type of address – if you wish to update all of the addresses, you will be given that option.

5. Enter your new address.

6. Select whether or not to use the same address for your billing and mailing address.

7. Click SAVE.

When making updates to your policy you will see a panel on the right hand of your screen that reviews any rates changes and has a CONTINUE button at the bottom. When you are ready and have inputted all the changes you want to make, push the CONTINUE button. Keep in mind that all changes will not be saved unless you SUBMIT and PAY, which should be the very last screen. Some changes may require an electronic signature, but if a signature is required you will see this section appear near the end of updating your policy process.

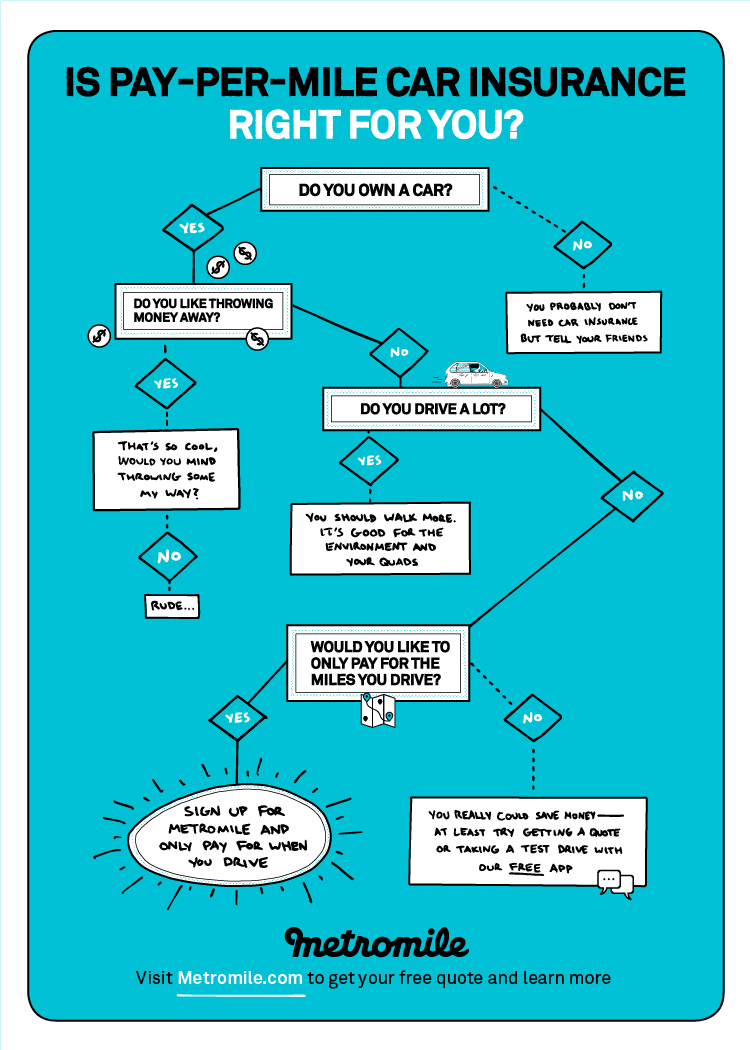

Now you are a self-service endorsement wizard! New car, new house, new driver, no problem. Any changes you will need in the future for your policy can all be done online when you log into your Metromile account. If you ever have any questions about your policy visit our Help Center, or you can find this page by clicking the “Contact Support” in the drop-down menu next to your name when you are logged into your account. If you haven’t yet made the switch to per-mile insurance, but are interested in making your auto insurance simple and easy, get a free quote today.

Kelsey Glynn is a blogger and owner of Social Graces, a business to support others in their social media needs. She is a contributing blog writer for East Valley Moms Blog, a social media content creator, and an avid photo taker. She is Metromile’s Senior Social Media Advocate and helps to maintain our online communities. You can catch her adventuring around AZ and living the mom life on Instagram.