If you’re in the market for a new car insurance policy, it’s important to find the right coverage and deductible for you. Ultimately, how much protection you have and what you pay out-of-pocket are based on the type of coverage you get and the car insurance deductible you choose. It can be tempting to choose the highest deductible as that often results in a lower monthly premium. While that may result in savings in the short term, it could mean paying more in the long term. Find out what to consider when choosing a car insurance deductible for your needs, budget, and lifestyle.

What is a car insurance deductible?

A car insurance deductible refers to the total amount a policyholder pays out-of-pocket before the insurance covers a qualified incident. For example, if you get into a fender bender that results in $2,000 of repairs and you have a $500 car insurance deductible, you’re on the hook for $500, and your car insurance company will cover the remaining $1,500.

As a policyholder, you get to choose your car insurance deductible. What makes car insurance coverage different from other types of insurance is that you’re responsible for paying the deductible each time you file a claim.

How does a car insurance deductible work?

If you get into a car accident or other type of incident covered under your policy, you’ll need to file a claim. This process can seem daunting, so it’s natural to wonder how does car insurance deductible work?

Insurance providers typically take out your car insurance deductible from the indemnity payment — which is the money you receive from a claim. You may also pay the deductible directly to the repair shop fixing your vehicle.

Your car insurance deductible is your responsibility and must be paid before your insurance provider covers the rest.

What are deductibles based off of?

As a consumer, you can typically choose a higher deductible and score a lower car insurance premium. On the other hand, you can select a low car insurance deductible and a higher premium, while lowering your out-of-pocket costs in the event of an accident.

However, car insurance coverage — including the car insurance deductible and the monthly premium you pay — is calculated based on risk. Your insurance provider sees each situation a bit differently.

Generally speaking, the idea is that if you have a high deductible — such as $1,000 or $2,000 — you may be less likely to file a claim for repairs and therefore considered less risky to your insurer. Remember that you pay your deductible and then have your insurance cover the rest. But if any damage or repairs are less than the cost of your deductible, then it’s not worth filing a claim.

On the other hand, if you choose a lower car insurance deductible between $100 and $500, the probability of you filing a claim goes up. That means you’ll likely pay a higher monthly premium and be considered more of a risk to your insurance provider.

The amount you choose for your car deductible can depend on your driving history, lifestyle, risk tolerance, and financial situation.

When do you pay the deductible for car insurance?

You don’t have to pay your car insurance deductible when selecting a car insurance policy. Instead, you pay your car insurance premium. You have to pay your car insurance deductible when you make a claim.

The car insurance deductible can be payable to either your repair shop or your insurance provider, depending on the amount, your plan, and your provider’s general deductible policy. Oftentimes, you’ll pay your deductible directly to your repair shop, and your insurance provider will take care of the remaining bill.

But remember, ultimately, paying your deductible is up to you. If you would rather not submit a claim, you don’t have to pay your deductible, but you will be responsible for the entire cost of your repair.

What are the different types of auto insurance deductibles?

When you choose an auto insurance policy, you sign up for a specific type of coverage that can help out in certain situations. In many cases, these coverage options have deductibles.

Comprehensive coverage

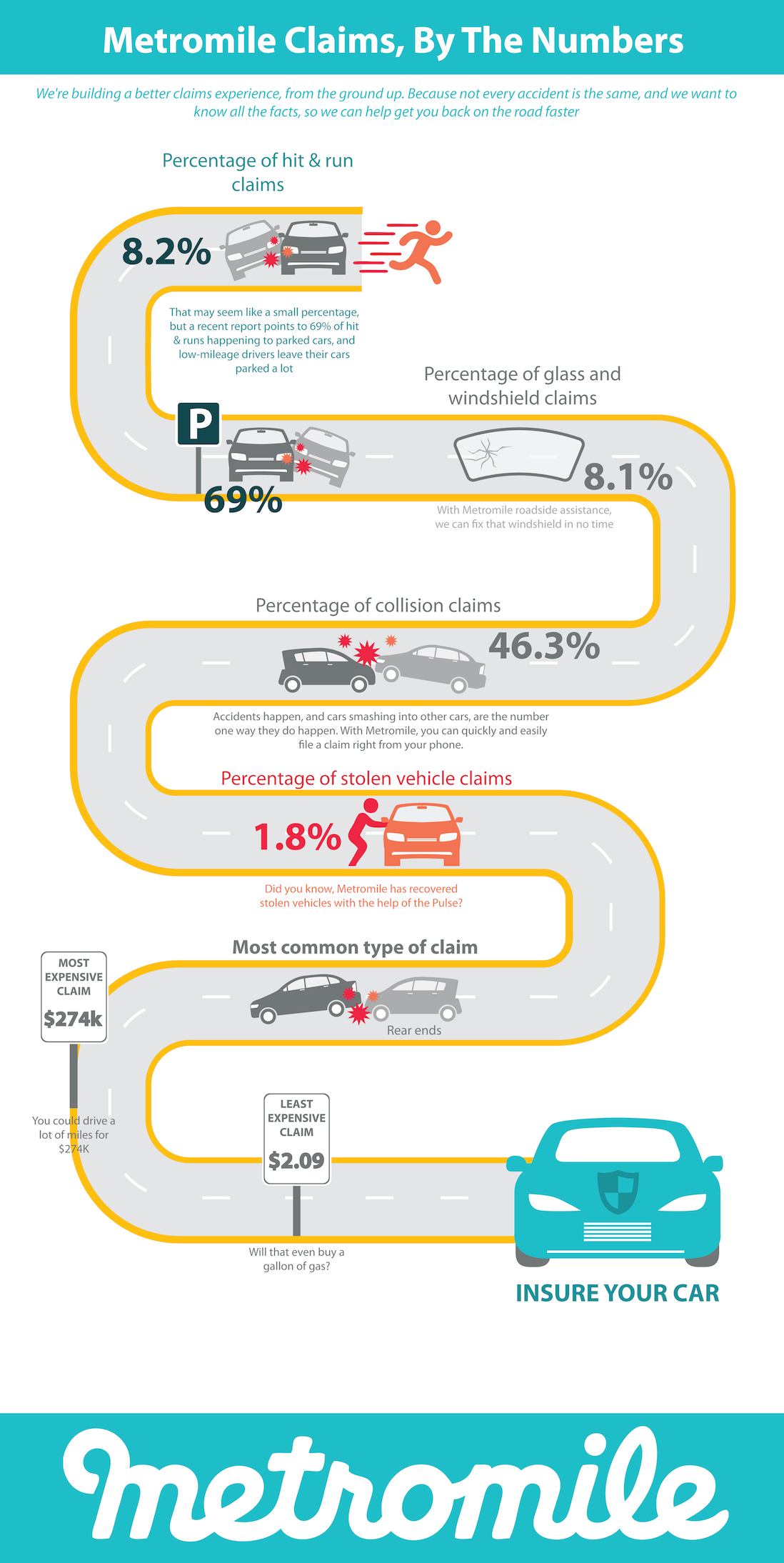

Comprehensive coverage covers the cost of repairing or replacing your vehicle in situations outside of a standard collision. So if your car gets damaged in a freak hailstorm or hit by a deer, or ends up being stolen, comprehensive coverage will come to the rescue. This type of coverage is typically sold in tandem with collision insurance.

Collision coverage

Collision coverage offers coverage for — you guessed it — in the event of a collision. It doesn’t matter whether you’re found at-fault or not. This type of coverage helps cover the cost of repairs or any needed replacements if there’s an incident.

Uninsured and underinsured coverage

Another type of coverage is uninsured and underinsured coverage. In the event you get into an accident with an uninsured motorist or one with limited coverage, this type of insurance can help cover costs. Considering that 1 in 8 motorists are uninsured, it could be a smart idea. This may not be offered in every state or by every insurance provider.

Personal injury protection (PIP)

Medical costs are a concern for many people. Personal injury protection insurance can help cover medical costs after an accident regardless of who is found at-fault. Some states like New Jersey require this type of insurance as it’s considered a “no fault” state. But not all states do, and it can be up to you whether to get PIP coverage or not.

How do I choose the right car insurance deductible amount?

Figuring out the right car insurance deductible amount can be tough. It’s important to evaluate your budget, risk tolerance, driving history, and coverage needs. If you choose a higher car insurance deductible, it’s likely you’ll have a lower premium. That may be good day-to-day, but it may mean your insurer will cover less. If you do need your car insurance, make sure you can afford your deductible or have that amount saved in an emergency fund.

If you select a lower car insurance deductible amount, it’s likely your premium will be higher. While you’re paying more now, if something happens down the line and you get into an accident, you’ll pay less out-of-pocket then.

Your deductible amount should be something you feel comfortable paying or have easy access to in an emergency fund, or as a last resort, a line of credit. The last thing you want is to get into an accident and stress about a high deductible that feels out of reach.

But you also don’t want a premium that feels like it’s hurting your budget each month. That’s why it’s a delicate balance, and you want to find the right amount for your budget and needs.

Select a deductible amount that feels doable for you. Even if you have a spotless record, remember things happen. It’s also important to be aware of what exactly is covered in your insurance policy.

For example, if you opt for liability-only that covers damage and injury costs for the other driver if you’re at fault. On the other hand, comprehensive and collision insurance can cover accidents, theft, and weather events that can come out of nowhere.

You can choose the deductible amount for each type of coverage, so if you think you are a safe driver, it might make sense to have a higher collision deductible (where you can often prevent a crash) versus comprehensive (where the events are typically out of our control).

The bottom line

If you’re looking for a new car insurance policy, you want to pick a car insurance deductible amount that works for you. That means considering your risk levels, needs, finances, and more. You also want to make sure you have the right coverage to protect yourself in various situations. And if you don’t drive very much? You can pay less with pay-per-mile car insurance with Metromile. If you’re still paying for miles you aren’t driving, it’s time to rethink your auto insurance coverage. Grab a free quote with Metromile today.